Comprehensive Commercial Mortgage Loans

Financing for commercial real estate, multifamily properties, mixed use, and more.

The LoanBud Advantage: Commercial Mortgages Loans

Diverse Loan Products

We offer a comprehensive range of loan products to suit your specific financing requirements, including CMBS loans, multifamily, bridge, construction, commercial real estate bridge loans , construction loans and mezzanine loans.

Expert Guidance

Our team of experienced loan specialists has extensive knowledge of the commercial real estate debt market, ensuring that you receive expertise and guidance throughout the process of acquiring commercial real estate loans.

Simple Application Process

Our streamlined application process makes securing the financing you need for your commercial, multifamily, or mixed-use property easy.

The LoanBud Advantage: Commercial Mortgages Loans

Access to Capital

With LoanBud commercial mortgage loans, you gain access to the capital you need through our extensive network of 100+ trusted lenders.

Real Estate for Your Business

Purchase owner-occupied commercial real estate for your business with up to 100% financing using an SBA loan.

Peace of Mind

At LoanBud, we understand that securing financing can be a stressful experience, so we work hard to provide you with a hassle-free and efficient process.

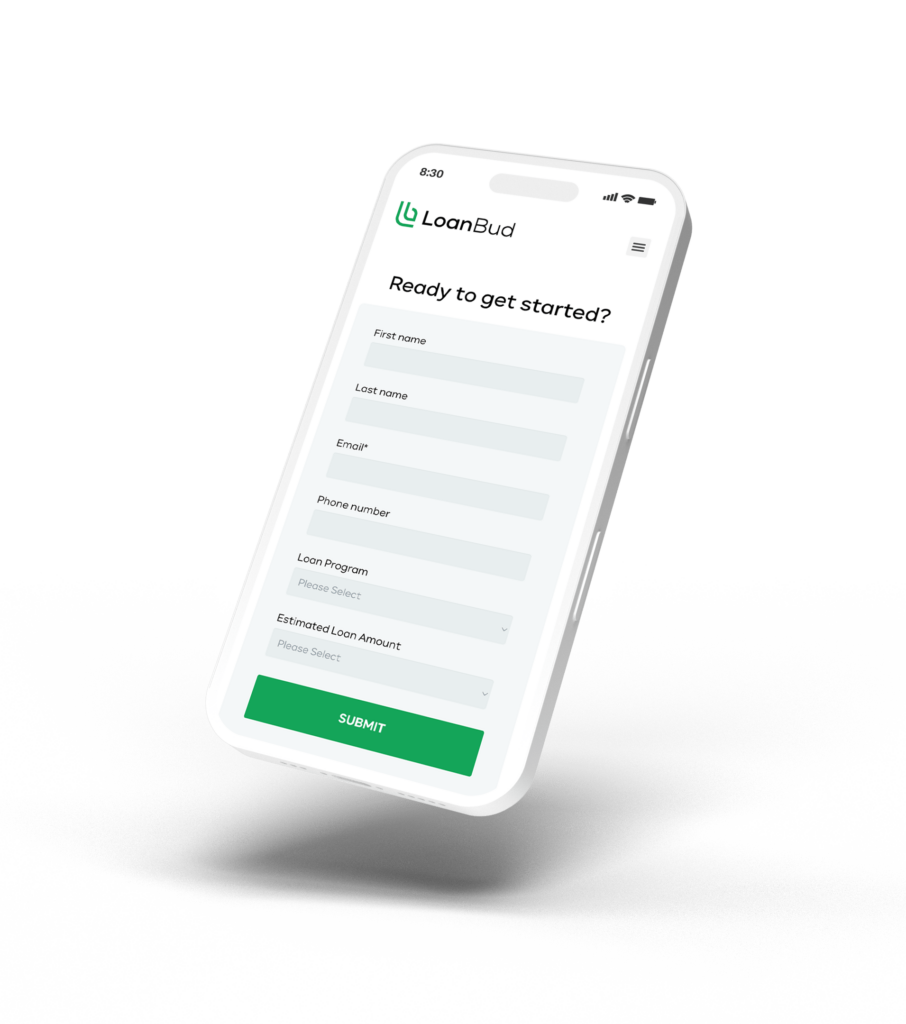

Ready to Get Started?

Answer a Few Simple Questions

Answer a few questions to let us know more about what you're looking for and check eligibility.

We’ll Connect You With a Business Loan Specialist

Our trusted and experienced specialists will help match you with the best option for your business. With over 100 lending partners, we'll work together to find the right solution for you.

Guide You Through the Application Process

Your loan specialist will work with you throughout the process, streamlining an otherwise overwhelming experience.

Get Funded

Get the capital you need to grow your business.

What Sets Us Apart

Expert Guidance

Our experienced team provides expert guidance, helping you navigate the complex world of commercial real estate loans and ensuring you make the right decision for your business.

Customized Solutions

We understand that every transaction is unique, and we work with you to create a customized financing solution tailored to your specific goals.

Diverse Financing Options

We offer a wide range of real estate financing options such as bridge loans for commercial real estate, loans for rental properties, fix-and-flips, ground-up construction, and more so you can choose the option that best fits your business needs.

Fast and Reliable Funding

Get the funding you need quickly and easily so you can stay focused on growing your business.

Achieve Your Commercial Real Estate Goals with LoanBud

LoanBud is your trusted partner for Commercial Real Estate Loans. Our extensive range of loan products includes CMBS loans, agency, multifamily, bridge, and commercial real estate construction loans.

In addition, we have the expertise and resources to help you unlock the full potential of your commercial property. Whether you’re looking to finance an office building, retail space, warehouse, self-storage facility, multifamily property, or a mixed-use development, our team is here to support you every step of the way.

Trusted Lending Partner

At LoanBud, we understand the importance of finding the right financing solution for your commercial property needs.

Whether you’re looking to purchase a commercial property or refinance an existing one, our team of experts is here to guide you through every step. With years of experience in commercial real estate loans, we have the knowledge and expertise to provide you with the best financing options for your unique situation.

We specialize in commercial mortgage loans and multifamily financing and are committed to helping you achieve your financial goals.

Partnering with LoanBud means working with a trusted and reliable team that puts your needs first. Let us help you secure the funding you need to take your commercial property investment to the next level.

What Our Customers Have to Say

“William Bennett has redefined what the client rapport should be. He has gone above and beyond to ensure the process was streamlined for our company. He efficiently communicated and assisted throughout the entire process. I refuse to go through any other lender going forward for all our financial needs. Bill, Thank you for the amazing experience.”

“I was Assigned Angela Sharrett as my first point of contact for an SBA backed loan. She was and continues to be amazing. She worked literally around the clock to make it happen. SBA backed loans are very complex and it can take a mental toll on everyone involved. I’m so grateful I was assigned Angela and her team at LoanBud. I cannot recommend them enough!”

“Melissa was amazing….assisted and supported us through the entire process…We couldn’t have been happier…highly recommend!”

“Jon Rector was my loan officer. He got up to speed on my loan immediately and was instrumental in closing my loans with the least amount of frustration on my part. He was responsive and attentive to my needs. I really appreciate his efforts.”

Have 5 Minutes? Apply Online

Check to see if you pre-qualify without impacting your credit score.