Full Service Financing for Your Business

We offer comprehensive lending options for business owners and real estates investors

Trusted Lending Partner

Business Owners: Don’t Let Financing Hold You Back

LoanBud offers flexible solutions to meet the needs of entrepreneurs.

SBA Loans

Grow your business, buy a business, or start a new one with SBA Loans with low rates and flexible terms.

Real Estate Loans

Your one-stop solution to build, buy, renovate, or refinance your investment properties with ease

Small Business Financing

Quick access to equipment loans, terms loans, lines of credit, and working capital for your business.

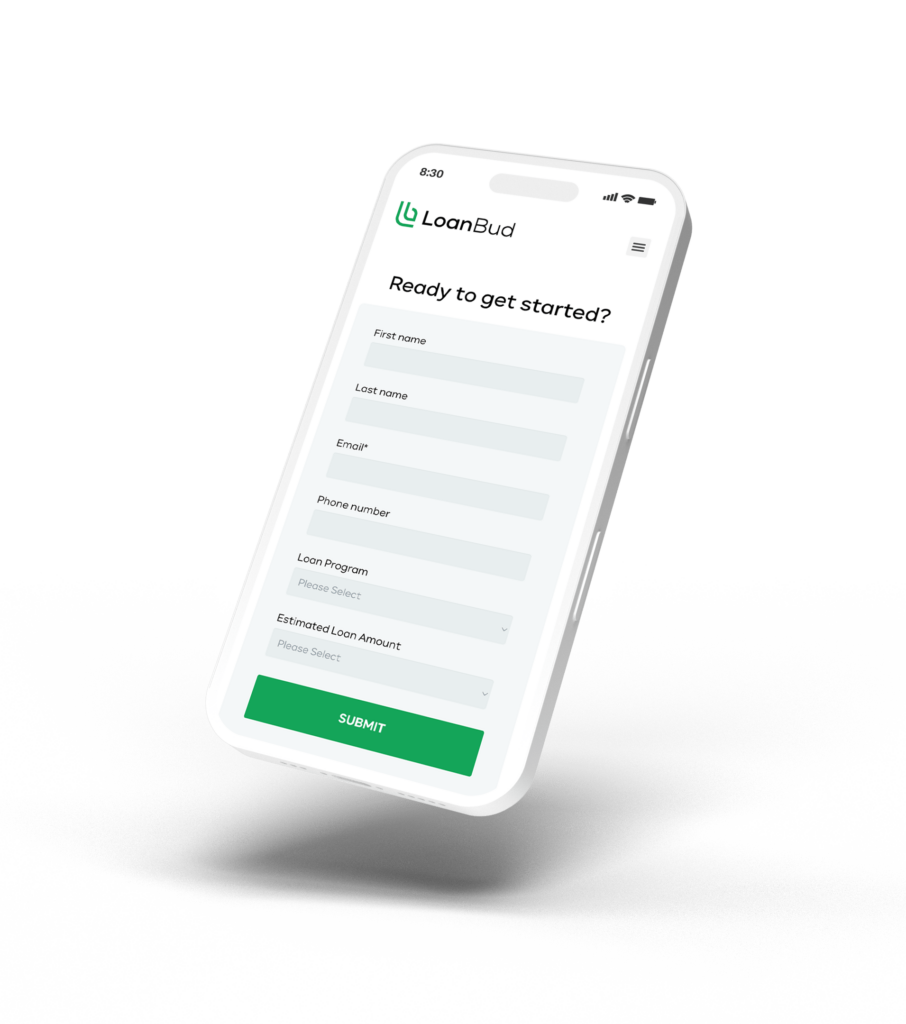

Ready to Get Started?

Answer a Few Simple Questions

Answer a few questions to let us know more about what you're looking for and check eligibility.

We’ll Connect You With a Business Loan Specialist

Our trusted and experienced specialists will help match you with the best option for your business. With over 100 lending partners, we'll work together to find the right solution for you.

Guide You Through the Application Process

Your loan specialist will work with you throughout the process, streamlining an otherwise overwhelming experience.

Get Funded

Get the capital you need to grow your business.

What Sets Us Apart

Expert Guidance

Our experienced team provides expert guidance, helping you navigate the complex world of small business financing and ensuring you make the right decision for your business.

Customized Solutions

We understand that every business is unique, and we work with you to create a customized financing solution tailored to your specific needs and goals.

Diverse Financing Options

We offer a wide range of financing options, including SBA loans, equipment loans, lines of credit, and more, so you can choose the option that best fits your business needs.

Fast and Reliable Funding

Get the funding you need quickly and easily so you can stay focused on growing your business.

Our Mission is to Empower and Grow Small Businesses

Financing shouldn’t be something you worry about; let us do that. At LoanBud, we believe small businesses are the backbone of America, and we understand the struggles you face when seeking financing. Endless paperwork, long wait times, and strict eligibility criteria can leave you feeling stuck and frustrated.

With a network of over 100 lenders and an experienced team led by former SBA bankers, we simplify an otherwise overwhelming process. Our team will guide you through the application process, ensuring a quick turnaround time and successful funding. Let’s grow your business together.

Tell us about what you need. You’re under no obligation, and it won’t impact your credit score.

What Our Customers Have to Say

“William Bennett has redefined what the client rapport should be. He has gone above and beyond to ensure the process was streamlined for our company. He efficiently communicated and assisted throughout the entire process. I refuse to go through any other lender going forward for all our financial needs. Bill, Thank you for the amazing experience.”

“I was Assigned Angela Sharrett as my first point of contact for an SBA backed loan. She was and continues to be amazing. She worked literally around the clock to make it happen. SBA backed loans are very complex and it can take a mental toll on everyone involved. I’m so grateful I was assigned Angela and her team at LoanBud. I cannot recommend them enough!”

"This was our second time working with LoanBud and Jon Rector and we couldn't be more satisfied. The entire process was fast and efficient. Jon stayed in constant contact updating me on the status each step of the way, even working nights and weekends to make sure our loan got processed as quickly as possible. I highly recommend Jon, Burke and everyone at LoanBud”

“Melissa was amazing...she assisted and supported us through the entire process of getting an SBA loan. We couldn’t have been happier with the loan experience. I highly recommend Melissa Buehner and LoanBud!”

“Jon Rector was my loan officer. He got up to speed on my loan immediately and was instrumental in closing my loans with the least amount of frustration on my part. He was responsive and attentive to my needs. I really appreciate his efforts.”

“Not only were they on top of everything and worked hard to make the process as easy as possible, they were a true advocate for me as the client. Truly appreciate Will going the extra mile for me and getting me to closing. I highly recommend LoanBud and Will..”

The Capital You Need to Grow Your Business, NOW

With loans closed in as little as 24 hours, you can get the funds you need for working capital, equipment, inventory and more. Our experienced team and seamless process reduces the time it takes to fund your loan.

Why Businesses Love Us

Our clients are our partners. Our team has over 100 years of collective banking experience; we’re your advocate and guide you to a successful loan funding.